Saturday, February 6, 2010

If 'Unsustainable' Is New Normal, Collapse Is Closer Than We Think

Columnist and best-selling author Mark Steyn says Barack Obama doesn't know much about economics, which is not good news considering the shape the U.S. economy is in right now.

From his latest column in Investor's Business Daily:

Obama's spending proposes to take the average Bush deficit for the years 2001-08 and double it, all the way to 2020. To get out of the Bush hole, we need to dig a hole twice as deep for one-and-a-half times as long. And that's according to the official projections of his economics czar, Ms. Rose-Colored Glasses.

By 2015, the actual hole may be so deep that even if you toss every Obama speech down it on double-spaced paper you still won't be able to fill it up. In the spendthrift Bush days, federal spending as a proportion of GDP averaged 19.6%. Obama proposes to crank it up to 25% as a permanent feature of life.

But if they're "unsustainable," what happens when they can no longer be sustained? A failure of bond auctions? A downgraded government debt rating? Reduced GDP growth? Total societal collapse? Mad Max on the New Jersey Turnpike?

Read the full column at the link below:

Investors.com - If 'Unsustainable' Is New Normal, Collapse Is Closer Than We ThinkLabels: Barack Obama, Debt, Democrats, Economy

Wednesday, February 3, 2010

Newspaper: Fiscal Road To Ruin?

Barack Obama and Congressional Democrats are leading us over a cliff.

From Investor's Business Daily:

The proposed budget over the next decade would rack up $45.8 trillion in new spending, $9.1 trillion in deficits and more than $2 trillion in higher taxes on Americans. It will double the national debt held by the public to over $18 trillion, while raising taxes on 3.2 million small businesses and upper-income taxpayers — the very people the administration is counting on to pull us out of recession.

Based on recent estimates, the expected deficits are growing, not shrinking. Last year's proposed budget contained just $7.1 trillion in red ink over 10 years. This year, that's ballooned to $9.1 trillion. Higher spending is responsible for 90% of the increase. Total spending over the decade is expected to swell 54%.

During the decade, spending will average about 24% of GDP — compared with the 20% of GDP that has prevailed since shortly after World War II. This represents a permanent 20% increase in the real size of government — which explains why the number of federal employees has reached 2.15 million, the most ever.

If spending isn't brought under control soon, the U.S. will suffer the fate of all fiscally irresponsible nations — slower economic growth, lower standards of living, shorter lives.

Read the full editorial at the link below:

Investors.com - A New Era Of IrresponsibilityLabels: Barack Obama, Congress, Debt, Democrats, Economy, Taxes

Tuesday, February 2, 2010

PA Business Community Says 'No State Budget Groundhog Day'

From the Pennsylvania Competitive Council:

More than 30 business organizations representing nearly 5 million non-farm, non-government private sector jobs assembled in the state capitol rotunda on Groundhog Day to say, "We don't want to wake up morning after morning to the same news in 2010!" The Groundhog Day reference to the Bill Murray movie that made Punxsutawney world famous was used by business leaders to remind lawmakers and Governor Rendell that another late budget with increased spending and higher taxes would not be acceptable to them.

"In 2009, we suffered a protracted budget process that went 101 days beyond the deadline. The gap between spending and expected revenues was filled with new and additional taxes that will cost the Pennsylvania business community about $2 billion over the next five years before modest – but much needed – tax reforms really take effect," said Pennsylvania Business Council President & CEO David W. Patti.

Read the full release at the link below:

Pennsylvania Business Community Says 'No State Budget Groundhog Day'Labels: Economy, Pennsylvania, Taxes

Thursday, January 28, 2010

Toomey Opposes Bernanke Confirmation

Good thing Ben Bernanke's confirmation vote is taking place now and not after November.

If he were in the U.S. Senate today, Pat Toomey says he would vote against confirming Ben Bernanke for chairman of the Federal Reserve.

Toomey, who is seeking the Republican nomination to run for U.S. Senate from Pennsylvania, gave several reasons for his opposition to Bernanke, chief among them was the Fed's central role in precipitating the current economic recession.

From a statement issued by Toomey:

For three years, from 2002 through 2005, the Fed maintained negative real interest rates, taking the nominal Fed Funds rate to a low of 1% in June 2003. These unnaturally low interest rates created a powerful incentive for individuals and institutions to leverage excessively, which created a credit bubble. This, in turn, created the residential real estate bubble, the collapse of which precipitated the crisis.

Mr. Bernanke was a member of the Fed Board from 2002 until he was sworn in as Chairman in 2006, and was a member of the Federal Open Market Committee, the committee directly responsible for setting short-term interest rates.

"This was a difficult decision," Toomey said. "I have great respect for Chairman Bernanke's intellect and expertise, and I believe he has tried to do what he believes is best for the country and its economy. However, Chairman Bernanke's refusal to acknowledge the role the Fed played in creating the current financial and economic crisis leaves little assurance that the Fed will not repeat those errors under his continued leadership."

"In addition, I have concerns about Chairman Bernanke's participation in the extralegal activities in the fall of 2008 and the recent politicization of his confirmation, which raises question about his potential susceptibility to political pressure. I have a lot of respect for Chairman Bernanke, but it is crucial that we learn from the mistakes that led to this economic crisis. Without that acknowledgement, I cannot give him my support."

For more information about Toomey, visit his campaign Web site,

www.toomeyforsenate.comLabels: Congress, Economy, Pat Toomey

Monday, January 25, 2010

World's Freest Economy? Not the U.S.

"When institutions protect the liberty of individuals, greater prosperity results for all."

"When institutions protect the liberty of individuals, greater prosperity results for all." -- Adam Smith, "The Wealth of Nations"

The United States could do no better than 8th place on the 2010 Index of Economic Freedom, jointly published by The Heritage Foundation and The Wall Street Journal.

And if Barack Obama and Congressional Democrats have anything to say about it, the U.S. could tumble further down on the list.

For the 16th consecutive year, Hong Kong ranked No. 1 as the world's freest economy, according to the 2010 Index of Economic Freedom.

Hong Kong's "economic freedom score" is 89.7, making its economy the freest among the 179 countries ranked. Singapore retains the second place ranking, followed by Australia and New Zealand. The United States ranks 8th place - behind Canada!

Here's what the authors of the Index had to say about the U.S.:

Its score is 2.7 points lower than last year, reflecting notable decreases in financial freedom, monetary freedom, and property rights. The United States has fallen to 2nd place out of three countries in the North America region.

The U.S. government's interventionist responses to the financial and economic crisis that began in 2008 have significantly undermined economic freedom and long-term prospects for economic growth, according to the authors. "Economic freedom (in the United States) has declined in seven of the 10 categories measured in the Index."

The 2010 Index measures the degree of economic freedom of 179 economies worldwide by assessing 10 factors: Business freedom, trade freedom, fiscal freedom, government spending, monetary freedom, investment freedom, financial freedom, property rights, freedom from corruption and labor freedom.

Why is Hong Kong ranked No. 1?

The Index says Hong Kong's "competitive tax regime, respect for property rights, and flexible labor market, coupled with an educated and highly motivated workforce, have stimulated an innovative, prosperous economy." The Index also notes that Hong Kong's legal and regulatory framework for the financial sector is "transparent and efficient."

You can download the entire 2010 Index of Economic Freedom for free at

http://www.heritage.org/index/Labels: Economy

Tuesday, January 12, 2010

Top business leader attacks Obama agenda

The head of the nation's largest business advocacy group, Tom Donohue, president of the U.S. Chamber of Commerce, has said publicly what most Americans have already figured out: Obama is bad for business.

And unless the Obama/Pelosi/Reid agenda is stopped. more Americans will be out of a job.

From POLITICO:

Chamber of Commerce President Tom Donohue gave a scathing assessment of the Obama administration’s business agenda on Tuesday — and delivered a clear threat to Democrats running for election in 2010.

"We are not in presidential politics," said Donohue. "But we're going to be in a lot of politics in the House and the Senate and the judicial politics in this country."

Donohue criticized proposals to reform health care, overhaul the financial system and cap the amount of greenhouse gases in the atmosphere, saying the Democratic agenda will undermine private industry and eliminate jobs.

"Congress, the administration and the states must recognize that our weak economy simply could not sustain all the new taxes, regulations and mandates now under consideration," said Donohue. "It's a sure-fire recipe for double-dip recession, or worse."

Read the full story at the link below:

Chamber chief attacks Obama agenda - Lisa Lerer - POLITICO.comLabels: Barack Obama, Democrats, Economy, Jobs

Thursday, December 17, 2009

Ben Bernake 'Villain of the Year 2009'

The honor just keep pouring in for Federal Reserve Chairman Ben Bernanke. On the same day he was named Time magazine's 2009 Person of the Year, Bernake was also selected 2009 Villain of the Year by the National Inflation Association.

The Association is a citizen watchdog group that is concerned about the growing threat of hyper-inflation due to unchecked spending by the federal government and the uncontrolled printing of money by the Fed.

While the far-left staff at Time magazine thinks Bernanke helped prevent a second Great Depression, the folks at the National Inflation Association believe Bernanke has sown the seeds of a massive collapse of the U.S. dollar and the world economy.

When it costs $20 for a gallon of milk in a few years, Americans will have nobody to thank more than Bernanke, the Association says.

Who's right? My money (for what it's worth) is on the National Inflaton Association.

NIA Names Bernanke Villain of the Year 2009Labels: Debt, Economy, Government Spending

Sunday, December 13, 2009

PA Tax Delinquent List Grows

Some 244 businesses on the Pennsylvania Department of Revenue's tax delinquent list owe the state more than $8 million, according to Revenue Secretary Stephen H. Stetler.

"These businesses collected taxes from their customers and employees but failed to send the money to the commonwealth," Stetler said in a prepared statement. "I encourage taxpayers to visit the department's Web site --

www.revenue.state.pa.us -- to see the list of delinquent businesses."

From the Department of Revenue:

Thirty-two new delinquent taxpayers were added to the list this month, including: Allegheny Answering Services, Pittsburgh ($117,120.38); Petz Unlimited Inc., Mechanicsburg, Cumberland County ($17,381.60); Urology Group Inc., Bala Cynwyd, Montgomery County ($33,980.60); Edwin C. Hill dba Hills Auto Repair, Altoona, Blair County ($7,832.51); Energetics Mechanical Inc., Easton, Northampton County ($8,977.58); and EMS Management Systems Inc., Kingston, Luzerne County ($38,009.86).

The list includes businesses that owe sales and/or employer withholding taxes. Since the list debuted in April 2006, 509 of the 753 businesses, or 67.6 percent, that appeared on the list have been removed because they paid taxes in full, committed to deferred payment plans or went out of business.

Businesses on Pennsylvania's Tax Delinquent List Now Owe $8 Million; 32 Firms Added to ListLabels: Economy, Pennsylvania, Taxes

Thursday, December 10, 2009

Dems keep printing money

The United States is running out of money to pay its bills. So what do the Democrats have in mind? Print more money, of course.

From POLITICO:

In a bold but risky year-end strategy, Democrats are preparing to raise the federal debt ceiling by as much as $1.8 trillion before New Year's rather than have to face the issue again prior to the 2010 elections.

"We've incurred this debt. We have to pay our bills," House Majority Leader Steny Hoyer told POLITICO Wednesday. And the Maryland Democrat confirmed that the anticipated increase could be as high as $1.8 trillion — nearly twice what had been assumed in last spring's budget resolution for the 2010 fiscal year.

The leadership is betting that it's better for the party to take its lumps now rather than risk further votes over the coming year. But the enormity of the number could create its own dynamic, much as another debt ceiling fight in 1985 gave rise to the Gramm-Rudman deficit reduction act mandating across-the-board spending cuts nearly 25 years ago.

Read the full story at the link below:

Dems to lift debt ceiling by $1.8 trillion, fear 2010 backlash - - POLITICO.comLabels: Barack Obama, Congress, Debt, Democrats, Economy, Government Spending, Inflation

Friday, October 30, 2009

Did Obama 'save' your job?

U.S. Rep. Joe Pitts, who represents Pennsylvania's 16th Congressional District, wants to set the record straight about the latest bogus announcement by the Obama Administration that it has "created or saved" 650,000 jobs.

Earlier this week, The Associated Press reported that the official count of "created or saved" jobs from the $787 billion stimulus was 25,000. It's amazing what you can do with numbers.

Obama released figures from his economic team stating that more than 40,000 jobs have been "created or saved" in Pennsylvania by passage of the stimulus bill, according to Pitts.

Nationwide 650,000 jobs have been "created or saved" at the cost of approximately $1.2 million each, Pitts says. Economists agree that the figure of jobs "saved" is misleading and is not a legitimate economic measure, Pitts says.

Pennsylvania has lost nearly 200,000 jobs in just the past year alone. Nationwide, more than 15 million Americans are out of work. The unemployment rate in the U.S. stands at a 27-year high.

Rep. Pitts' statement follows:

"Once again the administration is claiming that the wasteful $787 billion stimulus bill has 'saved' a distinct number of jobs. The White House has produced a number that is meaningless. There is no way to count jobs that weren't lost. I could just as easily come up with a formula to count the jobs that have been lost due this Administration’s policies on energy, health, and taxation.

"The truth is, unemployment is nearly two percent higher than the President projected. The administration’s website right now shows only one job saved in the entire 16th Congressional District. I understand that these numbers may be updated later today but they certainly won’t change very much. Right now this website shows that one job was created at the cost of $277,000 in government contracts.

"The government cannot create jobs, but it can make is easier or harder for employers to increase their payroll. With job-killing tax hikes in health care reform and the energy legislation being considered in Congress right now, how can we expect employers to invest in their business with confidence?"

Labels: Barack Obama, Broken Promises, Economy, Jobs, Rep. Joe Pitts

Thursday, October 15, 2009

PA unemployment rate hits 8.8%

Pennsylvania employers shed another 10,300 jobs in September, according to new employment figures released today by the Pennsylvania Department of Labor & Industry.

The Rendell Administration is attempting to put the best possible spin on the continuing bad news by pointing out that Pennsylvania's 8.8% unemployment rate "remained below the United States' unemployment rate, which rose one-tenth of a point to 9.8 percent."

Doesn't that make you feel better, especially if your unemployment benefits are about to run out?

The bottom line is that Ed Rendell, Barack Obama and Congressional Democrats have done a terrible job dealing with economic issues, resulting in record unemployment.

From the Pennsylvania Department of Labor & Industry:

Pennsylvania's seasonally adjusted civilian labor force -- the number of people working or looking for work -- rose by 9,000 in September to 6,368,000.

Employment was unchanged in September, while resident unemployment rose by 9,000.

The Pennsylvania labor force was down 55,000 from September 2008.

Pennsylvania's seasonally adjusted unemployment rate was up one-tenth of a percentage point to 8.8 percent in September.

The state rate remained below the United States' unemployment rate, which rose one-tenth of a point to 9.8 percent.

Pennsylvania's rate was up 3.2 percentage points from September 2008, while the U.S. rate was up 3.6 percentage points in the 12-month period.

Pennsylvania's seasonally adjusted total nonfarm jobs count dropped by 10,300 jobs in September.

The majority of the job losses were among service providing industries, however, the Professional and Business Services sector added 2,700 jobs.

Pennsylvania job count was down 198,100, or 3.4 percent, since September 2008. Nationally, jobs were down 4.2 percent over the same time period.

Labels: Barack Obama, Broken Promises, Democrats, Economy, Jobs, Pennsylvania, Rendell

Saturday, September 26, 2009

Inflation Could Spell End of U.S. Financial System

This is scary stuff. If the policies of Barack Obama and Congressional Democrats are not stopped, we will see the collapse of the United States.

From the National Inflation Association:

It took 25 years for our national debt to double from $257 billion in 1950 to over $533 billion in 1975. Most recently, our national debt has more than doubled from $5.8 trillion in 2001 to its current level of $11.8 trillion in just eight years. Our national debt is now growing three times faster that it did decades ago, which means we should expect a very minimum of three times faster inflation.

Inflation Could Spell End of U.S. Financial SystemLabels: Barack Obama, Debt, Democrats, Economy

Wednesday, September 23, 2009

Poll: 60% view Obama's handling of economy as negative

A new Harris Poll released shows growing discontentment over Barack Obama's handling of the economy.

Three in five Americans (60%) rate the job the president is doing on the economy as negative while two in five (40%) rate his job as positive, according to The Harris Poll.

The numbers are virtually unchanged from last month when 39% rated President Obama's economic job performance as positive and 61% rated it as negative, according to The Harris Poll.

More from The Harris Poll of 2,334 adults surveyed online between Sept. 8-15, 2009, by Harris Interactive:

Confidence in the White House

Confidence in the White House and the Administration to produce policies to help fix the economic crisis has dropped in the past month. In August, over half of Americans (53%) had confidence while 47% did not have confidence. One month later, over half of Americans (52%) now are not confident that the Obama Administration can produce policies to help fix the economic crisis while 48% are confident they will.

Financial conditions ahead

Overall, two in five Americans (40%) expect the economy to improve in the coming year while just over one-third (36%) say they expect it to stay the same and one-quarter (24%) believe it will get worse. In August, almost half (46%) of Americans believed the economy would improve in the coming year.

When it comes to household's financial situation, about half of Americans (48%) believe it will remain the same in the next six months while one-quarter (23%) say it will get better and three in ten (29%) believe it will get worse. This is almost unchanged from last month when 48% said it would remain the same, 24% said it would get better and 28% of Americans believed their household's financial situation would get worse.

The job market

When it comes to the job market, attitudes are mostly negative. Two-thirds of Americans (68%) say the current job market in their region of the country is bad while just one in ten (10%) say it is good and 22% believe it is neither good nor bad. Last month, 71% of Americans said the job market in their region was bad and 8% said it was good. Those in the West and Midwest are most negative about the job markets in their region (77% and 70% saying it is bad respectively) while 15% of Southerners say it is good.

Full data tables and methodology are available at

www.harrisinteractive.comLabels: Barack Obama, Broken Promises, Economy

Friday, September 18, 2009

Keep telling yourself the recession is over

Barack Obama and his media allies are jumping on the slightest bit of positive economic news to tell the American people that the recession is over.

Just tell that to the 15 million Americans who are out of work. Millions of those jobs have been lost during the Obama administration and most of them will never come back.

Today's headline:

42 states lose jobs in August, up from 29 in JulyFrom The Associated Press:

WASHINGTON — Forty-two states lost jobs last month, up from 29 in July, with the biggest net payroll cuts coming in Texas, Michigan, Georgia and Ohio.

The Labor Department also reported Friday that 27 states saw their unemployment rates increase in August, and 14 states and Washington D.C., reported unemployment rates of 10 percent or above.

The report shows jobs remain scarce even as most analysts believe the economy is pulling out of the worst recession since the 1930s. Federal Reserve Chairman Ben Bernanke said earlier this week that the recovery isn't likely to be rapid enough to reduce unemployment for some time.

The jobless rate nationwide is expected to peak above 10 percent next year, from its current 9.7 percent.

Employers have eliminated 6.9 million jobs since the recession began in December 2007.

Texas lost 62,200 jobs as its unemployment rate rose to 8 percent in August for the first time in 22 years. The state's leisure, construction and manufacturing industries were hardest hit, losing 35,500 jobs.

Michigan saw 42,900 jobs disappear, including 15,000 in manufacturing, as the state continued to suffer along with its struggling auto industry.

Michigan's unemployment rate rose to 15.2 percent, the highest in the nation. When its jobless rate topped 15 percent in June it was the first time any state surpassed that mark since 1984.

Nevada has the second-highest rate at 13.2 percent, followed by Rhode Island at 12.8 percent and California and Oregon at 12.2 percent each.

The jobless rates in California, Nevada and Rhode Island were the highest on records dating to 1976. California and Nevada have been slammed by the housing bust, while Rhode Island has lost thousands of manufacturing and government jobs in the past year.

Georgia and Ohio reported the third and fourth-highest job losses, respectively, but their unemployment rates both fell as many of the unemployed dropped out of the work force.

Labels: Barack Obama, Broken Promises, Economy, Jobs

Thursday, September 17, 2009

PA unemployment rate hits 8.6%

Pennsylvania lost another 8,800 jobs in August, according to new numbers released today by the Pennsylvania Department of Labor & Industry.

State officials tried to put the best possible spin on the bad news by pointing out that Pennsylvania's 8.6% unemployment rate "remained below the United States' unemployment rate, which rose three-tenths of a point to 9.7 percent in August."

Doesn't that make you feel better?

Pennsylvania's unemployment rate was up 3.1 percentage points from August 2008, compared to an increase of 3.5 percentage points since August 2008 for the nation.

Since August 2008, Pennsylvania has shed 191,500 jobs!

Just a reminder that the governor of Pennsylvania is Ed Rendell, a Democrat, who has increased spending by $8 billion since 2003. Much of that spending went for various economic revitalization projects that Rendell claimed would bring more jobs to the state.

And in case you forgot, the Democrats also control both houses of Congress and the White House. If you're one of the 15 million Americans out of work, be sure to thank a Democrat in Harrisburg or Washington, D.C.

For a detailed breakdown of the employment numbers, follow the link below:

Pennsylvania's Employment Situation: August 2009Labels: Democrats, Economy, Jobs, Pennsylvania, Rendell

Friday, September 11, 2009

Obama recession could get much worse

Despite the spin from the Obama media about the U.S. has "turned the corner" on the current recession, there are ominous signs that the failed Obama economic policies of the past nine months could set the stage for even worse times ahead.

"The dollar is weakening, gold is hitting new highs and some foreign officials now want an alternative to the U.S. currency," writes Investor's Business Daily. "If you're looking for a market verdict on U.S. economic policy, look no further."

From the editorial:

As Heritage Foundation economist Brian Riedl notes, Washington is set to spend $30,958 per household this year — taking $17,576 in taxes and borrowing the rest from our kids.

If this were a temporary thing, it might not be so bad. But we're boosting federal spending from the 18%-to-22%-of-GDP range that has prevailed since World War II to 26% this year. And if Congress and the White House get their way, spending will stay at least that high forever — in effect, a 30% rise in real spending and taxes.

Investors worry about surging U.S. government debt, conservatively expected to grow by nearly $10 trillion over the next decade. Since every dollar the government spends comes from the private sector, that won't leave much for private investment here.

And this doesn't even count our exploding entitlements problem. We owe $51 trillion to Social Security and Medicare over the next 50 years or so — about $205,000 per person alive today.

By our foolish fiscal choices, we're in effect opting for stagnation and inflation over growth and prosperity. New regulations and government control of the auto, banking and financial services industries will lower corporate profits. So will higher taxes on individuals to pay for it all.

Read the full editorial, "Repeating History," at the

newspaper's Web site.

Originally posted at

TONY PHYRILLASLabels: Barack Obama, Debt, Democrats, Economy

Friday, September 4, 2009

U.S. unemployment at 9.7%

Monday, August 31, 2009

By The Numbers: 71,500

Today's number is 71,500.

That's the minimum number of Pennsylvania jobs that would be lost if the Waxman-Markey bill, better known as Cap-and-Trade, is passed by the Senate. The House already approved the bill and President Obama said he would sign it if passes both chambers of Congress.

The 71,500 estimate comes from the National Association of Manufacturers, which commissioned a study to look at the impact of the Waxman-Markey bill in each state. The job loss number could go as high as 97,500 in Pennsylvania.

More from the study:

Higher energy prices would have ripple impacts on prices throughout the economy and would impose a financial cost on households. Pennsylvania would see disposable household income reduced by $148 to $285 per year by 2020 and $926 to $1,507 by 2030.

The study concluded that bill would cots 2.4 million jobs across the United States.

To review the complete study, visit the National Association of Manufacturers Web site,

http://www.nam.org/Labels: Barack Obama, Congress, Democrats, Economy, Energy, Jobs, Taxes

Friday, August 28, 2009

By The Numbers: 81

Today's number is 81.

That's the number of U.S. banks that have failed since Barack Obama became president, according to the Federal Insurance Deposit Corp.

By comparison, just 26 banks failed in all of 2008 when Republican George W. Bush was president. In 2007, just 3 U.S. banks failed.

Industry analysts predict that another 150 to 200 banks will fail. Keep that in mind next time the Obama media tells you the recession is over.

Labels: Barack Obama, Debt, Democrats, Economy, Taxes

Thursday, August 27, 2009

Newspaper: Obama budget projections 'laughably implausible'

White House estimates of a $9 trillion budget deficit over the next 10 years ($2 trillion more than the White House predicted just a few months ago) are still way off the real deficit projections, according to an editorial in The Wall Street Journal.

The Congressional Budget Office predicts that debt held by the public as a share of GDP, which was 40.8% in 2008, will rise to 67.8% in 2019 — and then keep climbing after that, says the newspaper.

The CBO says this is "unsustainable," but even this forecast may be optimistic, the newspaper says.

From the editorial:

The real fiscal crisis in Washington is that neither Congress nor the White House are offering any escape from these trillion-dollar deficits. Mr. Obama has not called for automatic and immediate spending cuts. He has not proposed eliminating hundreds of wasteful programs. To the contrary, the White House still hasn't ruled out another fiscal stimulus, as if a $1.6 trillion deficit isn't Keynesian stimulus enough. The Administration's celebrated scrub through the budget this summer identified $17 billion in agency savings. That's what Uncle Sam is borrowing every three days.

Obamanomics has turned into an unprecedented experiment in runaway government with no plan to pay for it, save, perhaps, for a big future toll on the middle class such as a value-added tax. White House budget director Peter Orszag promises that next year's budget will have a "plan to put the nation on a fiscally sustainable path." Hide the children.

Read the full editorial, "The Pelosi-Obama Deficits," at the

newspaper's Web site.

Labels: Barack Obama, Debt, Economy, Taxes

Thursday, August 13, 2009

The Obama Recession Continues

Wednesday, August 12, 2009

14 PA firms make Inc. magazine list of fastest-growing private companies

Inc. magazine has published its 28th annual Inc. 500, "an exclusive ranking of the nation's fastest-growing private companies."

This might be a sign of the awful business climate in Pennsylvania under Gov. Ed Rendell, but the Keystone State has just 14 companies listed among the Top 500. And the highest-ranked Pennsylvania firm finished at No. 82.

California tops the Inc. 500 with 84 companies; Texas places second with 45, followed by Virginia and New York with 35 each.

Here are the Pennsylvania firms and their ranking:

82. DSG, Malvern

135. Clear Align, Eagleville

141. SingleSource Property Solutions, Canonsburg

169. The Neat Company, Philadelphia

174. PriceSpective, Blue Bell

211. ACI Estate, Doylestown

221. Cities2Night.com, Philadelphia

322. Geo-Solutions, New Kensington

328. Millenium Pharmacy Systems, Wexford

390. RAC Enterprise, West Hazleton

397. SoftNice, Allentown

416. AlphaCard Services, Huntington Valley

425. PeopleShare, Philadelphia

441. UniTek USA, Blue Bell

The 2009 Inc. 500 will be unveiled in the September issue of Inc. magazine available on newsstands Aug. 17, but is already posted at the magazine's Web site,

http://www.inc.comFor more background on the list, follow the link below:

Inc. Magazine Unveils 28th Annual List of America's Fastest-Growing Private Companies - the Inc. 500Labels: Economy, Pennsylvania

Tuesday, July 7, 2009

Economists worry about a 'double-dip recession'

As if Barack Obama and Congressional Democrats havent' done enough damage to the U.S. economy, a new report warns that another recession could hit in late 2010.

This assumes the U.S. recovers from the current recession, which has dragged on for 18 months and has been prolonged over the past six months by Obama's ill-advised economic policies.

From a story by Kent Hoover in the Philadelphia Business Journal:

The end of the recession is "literally just around the corner," the U.S. Chamber of Commerce's chief economist said, but there is a 15 percent to 20 percent chance of another economic downturn by late 2010.

Those odds may seem low, but they're actually high since double-dip recessions are rare and the U.S. economy grows 95 percent of the time, said the chamber's Marty Regalia.

He predicted that the current economic downturn will end around September but that the unemployment rate will remain high through the first half of next year. Investment won't snap back as quickly as it usually does after a recession, Regalia said.

Inflation, however, looms as a potential problem because of the federal government's huge budget deficits and the massive amount of dollars pumped into the economy by the Federal Reserve, he said. If this stimulus is not unwound once the economy begins to recover, higher interest rates could choke off improvement in the housing market and business investment, he said.

"The economy has got to be running on its own by the middle of next year," Regalia said.

Almost every major inflationary period in U.S. history was preceded by heavy debt levels, he noted.

On the bright side, a "double-dip" recession in 2010 will most like result in a backlash against Democrats in the midterm Congressional elections. The end of a Democratic majority in Congress would put a stop to Obama's socialist agenda for the remaining two years of his term.

Read the full story, "Economist: U.S. may see double-dip recession by late 2010," at the Philadelphia Business Journal's

Web site.

Labels: Barack Obama, Democrats, Economy, Michael Ramirez Cartoon

Monday, July 6, 2009

Democrats own economic mess now

From a recent editorial in Investor's Business Daily:

At this point in a normal downturn lasting 11 months, the economy should be booming — with big jumps in GDP and 300,000 new jobs each month coming mostly from the private sector.

But 18 months into this downturn, we're still losing jobs — with 2.7 million gone in the private sector just since January, when the Democrats took full control of the government.

Shrinking GDP has crushed investment. First quarter gross private domestic investment — a proxy for business investment — plunged 20%, or nearly $450 billion, annually. The outlook is grim.

Worse, the June jobs data mark a milestone of sorts: Our unemployment rate equals that of the no-growth Eurozone nations.

Why is this job decline happening? The private sector — the real engine of economic and job growth — won't hire because it's scared of what it sees coming out of Washington.

On the horizon, as far as the eye can see, are higher taxes, uncontrolled spending and layers upon layers of new regulations.

Who would hire new workers faced with that?

Read the full editorial at the

newspaper's Web site.

Labels: Barack Obama, Congress, Democrats, Economy, Jobs, Nancy Pelosi

Monday, June 8, 2009

'The Failure of Obamanomics'

Despite the propaganda from the White House and the white-washing of the severity of the current recession by the state-run Obama Media, the latest economic numbers paint a clear picture of failure on the part of Barack Obama and his advisers.

Most Americans are worse off today than they were five months ago when Barack Obama moved into the White House. Obama has managed to make the economic crisis worse. So much for that "hope and change" so many American voters fell for in November.

From a new column by Dick Morris and Eileen McGann:

The stimulus package was a total and complete failure. As predicted, as happened with Bush's 2008 tax cut, as happened with the Japanese stimulus packages of the '90s, fearful consumers sat on their money and wouldn't spend it. Keynesian economics didn't work. Again.

But the debt sure piled up. The deficit quadrupled and is sending interest rates soaring, as the government elbows aside businesses and consumers at the loan window, all in a desperate effort to borrow enough money to spend enough money to stimulate the economy, which isn't happening.

Read the full column at

Townhall.comLabels: Barack Obama, Broken Promises, Debt, Economy, Taxes

Friday, June 5, 2009

Unemployment rate jumps to 9.4 percent

Thursday, June 4, 2009

Obama's 'breathtaking deception'

Tony Fratto of CNBC has a problem with Barack Obama's bogus "jobs saved" claim:

"After nearly twenty years in Washington I thought I've seen every trick ever conceived, but the White House claims of "jobs saved" attributed to the stimulus bill is unrivaled. What causes the jaw to drop is not just the breathtaking deception of the claim, but the gullibility of the Washington press corps to continue reporting it."

If I -- or even my predecessors in the Clinton Administration -- had tried to pull off this ridiculous gimmick we would have been run out of town. I don't even believe it's possible to look back and accurately measure the "job-saving" impact of Bush or Clinton Administration policies, let alone to measure in real time, or project into the future.

On Friday the BLS will release its estimate of May job losses. They will also report their revisions for March and April. And White House officials will once again gear up the spin machine on how many jobs have been "saved".

A self-respecting press corps would vigorously question the White House on their claims. We'll see if we have one.

Read 'The White House 'Jobs-Saved' Deception' at the

CNBC Web site.

Labels: Barack Obama, Broken Promises, Economy, Jobs, Liberal Media Bias

Wednesday, May 13, 2009

Harvard economist: Obama tax hikes could kill recovery

"The barrage of tax increases proposed in President Barack Obama's budget could, if enacted by Congress, kill any chance of an early and sustained recovery," writes Martin Feldstein, chairman of the Council of Economic Advisers under President Reagan and a professor of economics at Harvard University.

From Feldstein's latest column in The Wall Street Journal:

Even if the proposed tax increases are not scheduled to take effect until 2011, households will recognize the permanent reduction in their future incomes and will reduce current spending accordingly. Higher future tax rates on capital gains and dividends will depress share prices immediately and the resulting fall in wealth will cut consumer spending further. Lower share prices will also raise the cost of equity capital, depressing business investment in plant and equipment.

The Obama budget calls for tax increases of more than $1.1 trillion over the next decade. Official budget calculations disguise the resulting fiscal drag by treating Mr. Obama's proposal to cancel the 2011 income tax increases for taxpayers with incomes below $250,000 as if they are real tax cuts. The plan to modify the Alternative Minimum Tax to avoid increases for some taxpayers is also treated as a tax cut.

But those are false tax cuts in which no one's tax bill actually declines. In contrast, the proposed tax increases are very real. And despite the proposed tax increases, the government's new spending and transfer programs would cause the annual budget deficit in 2019 to exceed $1 trillion, or 5.7% of GDP.

Read the full column at the

newspaper's Web site.

Labels: Barack Obama, Broken Promises, Debt, Economy, Taxes

Friday, May 8, 2009

The Obama recession continues

More bad economic news the Obama media may not get around to telling you about:

U.S. Unemployment Rate Jumps to 8.9 Percent (the highest since late 1983).

U.S. employers shed 539,000 jobs in April.

2.6 million Americans have lost their jobs since Obama became president.

Here's a month-by-month look at job losses under President Obama:

January: 741,000

February: 681,000

March: 699,000

April: 539,000

How's that stimulus spending working out so far? Even if Obama's prediction of creating 3 million new jobs is real, that just brings us back to square one. What about the millions of others who lost their jobs during the current recession?

Check out this post at

NewsBusters about how the Obama media is manipulating economic news to cover Obama's incompetence.

Labels: Barack Obama, Broken Promises, Economy, Jobs

Tuesday, March 10, 2009

Warren Buffett opposes Card Check

Friday, March 6, 2009

It's the Obama recession now

The nation's unemployment rate stands at 8.1 percent, the highest since 1983. More than 650,000 jobs were slashed in February.

"There is no light at the end of the tunnel with these numbers," Nigel Gault, economist at IHS Global Insight, told The Associated Press. "Job losses were everywhere and there's no hope for a turnaround any time soon."

It's March and Obama can't blame George W. Bush anymore.

U.S. companies eliminated 655,000 jobs during Obama's first month in office in January and now slashed another 650,000 jobs in February.

The Dow Jones Industrial Average has plunged to 6,500. Now we know what Obama meant by change -- change for the worse.

The recession is in its 15th month and there's no end in sight.

More than 12.5 million people are out of work. On top of that, the number of people forced to work part time for "economic reasons" rose 787,000 to 8.6 million, according to The Associated Press.

Obama, with Democratic control of Congress could have taken bold action to freeze government spending and slash taxes to jump-start the economy. Instead, he and Nancy Pelosi chose to increase government spending and proposed massive new taxes.

Since the recession began in December 2007, the economy has lost 4.4 million jobs, more than half of which occurred

in the past four months, according to The Associated Press.

Obama called the unemployment news "astounding," but urged the American people to give him time to let his economic revival plans take root. "All of this takes time and it will take patience," Obama said.

As many of us feared, the American people elected an amateur to lead the nation at this critical juncture. Obama is indifferent toward the plight of everyday Americans. He is clueless about the economy.

In short, we have another Jimmy Carter in the White House.

Labels: Barack Obama, Democrats, Economy

Wednesday, March 4, 2009

Newspaper: Obama running out of people to blame

Change isn't always a good thing, argues The Wall Street Journal, as it assesses the Obama Administrations failed attempts to jump-start the economy.

"As 2009 opened, three weeks before Barack Obama took office, the Dow Jones Industrial Average closed at 9034 on January 2, its highest level since the autumn panic," the newspaper writes. "Yesterday the Dow fell another 4.24% to 6763, for an overall decline of 25% in two months and to its lowest level since 1997. The dismaying message here is that President Obama's policies have become part of the economy's problem."

The current recession is in its 15th month with no signs of ending. If Barack Obama and the Democrats continue to have their way, the economic slump will continue to get worse, the newspaper says.

From an editorial about the Obama Administration's fumbling of the economy over the past five weeks:

The Democrats who now run Washington don't want to hear this, because they benefit from blaming all bad economic news on President Bush. And Mr. Obama has inherited an unusual recession deepened by credit problems, both of which will take time to climb out of. But it's also true that the economy has fallen far enough, and long enough, that much of the excess that led to recession is being worked off. Already 15 months old, the current recession will soon match the average length -- and average job loss -- of the last three postwar downturns. What goes down will come up -- unless destructive policies interfere with the sources of potential recovery.

Read the full editorial at the

newspaper's Web site.

Labels: Barack Obama, Broken Promises, Economy, Taxes

The Fix Is In

If you're wondering where your retirement account went or where your children's college fund went or why your job is no longer there, the answer can be found in a new report "Sold Out: How Wall Street and Washington Betrayed America."

As many people suspect, an unholy alliance exists between Wall Street and Washington to rob the American people blind.

"The financial sector invested more than $5 billion in political influence purchasing in Washington over the past decade, with as many as 3,000 lobbyists winning deregulatory decisions that led to the current financial collapse," according to a 231-page report issued today by Essential Information and the Consumer Education Foundation.

The report, "Sold Out: How Wall Street and Washington Betrayed America," shows that, from 1998-2008, the financial sector made $1.7 billion in political contributions and spent another $3.4 billion on lobbyists.

What did Wall Street get for its investment? A Congress (mostly Democrats) that looked the other way while a small group of greedy individuals plundered the American economy for their own benefit.

Follow the link below to read more from the report.

And kick yourself in the rear for re-electing the same clowns to Congress that got us into this financial situation.

$5 Billion in Political Contributions Bought Wall Street Freedom From Regulation, Report FindsLabels: Congress, Economy

Tuesday, March 3, 2009

Obama Knows Best: Just ignore the stock market

Barack Obama said today that Americans should ignore the tailspin on Wall Street as he pushes through with insane economic policies.

From The Associated Press:

"What I'm looking at is not the day-to-day gyrations of the stock market, but the long-term ability of the United States ... to regain its footing," Obama said after meeting in the Oval Office.

The president said he is "absolutely confident" that those things will happen. But Obama also said that it will take time for the mistakes of the past to work their way through the system and that the spectacular losses happening now are a "natural reaction" to those mistakes.

"We dug a very deep hole for ourselves," Obama said. "There were a lot of bad decisions that were made. We are cleaning up that mess. It's going to be sort of full of fits and starts, in terms of getting the mess cleaned up, but it's going to get cleaned up. And we are going to recover, and we are going to emerge more prosperous, more unified, and I think more protected from systemic risk."

I feel better, don't you?

The Dow has dropped 12 percent since Obama was sworn in as president. The Dow has dropped 52 percent since Democrats took control of Congress after the November 2006 election. How low can it go?

Labels: Barack Obama, Democrats, Economy

The numbers that count

The far left keeps pointing to opinion polls showing Barack Obama is still popular with the American public, but the numbers that count (the Dow) begs to differ.

The stock market has plunged to its lowest levels in 12 years under the Obama Administration.

More spending and higher taxes are not the answer.

American wealth is disappearing daily as Obama continues to fumble the economy. Eventually, the popularity numbers will drop.

Obama Stimulus Spending Ignores Small Business as Dow Continues to PlungeLabels: Barack Obama, Economy

Wednesday, February 25, 2009

Obama's Speech Ignores 98 Percent of U.S. Firms

Perhaps the American Small Business League should change its name. President Obama and Congressional Democrats continue to ignore the needs of small businesses, which are the backbone of the U.S. economy.

From a statement issued by the American Small Business League:

The stimulus bill signed last week by President Obama was designed primarily to create and preserve jobs. Yet not one line of the bill contains specific language to direct any of the stimulus bill's spending to the 98 percent of American firms that create over 97 percent of all new jobs.

Obama's Speech Ignores 98 Percent of U.S. FirmsLabels: Barack Obama, Economy

Tuesday, February 24, 2009

U.S. ranks 15th in protecting property rights

From Kelsey Zahourek, executive director of the Property Rights Alliance (PRA), on the release of the group's 2009 report:

"With regard to private property rights, PRA continues to champion the idea that physical and intellectual property are equally important in nature, and must be protected. Property rights contribute to increased levels of stability and provide people with the knowledge and comfort that their property will remain theirs. As property rights continue to face challenges around the world, we hope this study will be a useful tool for policymakers, think tanks, academics, and investors by highlighting the importance of property rights as a key building block for economic growth."

So who comes out on top when it comes to protecting property rights?

You might be surprised to learn that it is

not the United States, which didn't even make the Top 10.

From the report, which ranks 115 nations:

Finland leads the country list a third year in a row with an increased score from the previous two years of 8.7 out of the possible 10.

With a score of 8.5, the second position is occupied by Denmark and Netherlands this year. The fourth position is occupied by New Zealand, Sweden, Germany and Norway all with a score of 8.3. This year’s top ten countries are rounded up with Australia and Switzerland (both with a score of 8.2), and Austria, Iceland and Singapore (all with a score of 8.1). Of these countries, Australia moved up to rank 8 in 2009 from rank 11 in 2008 followed by Austria and Singapore both ranked 13 in 2008 to 10 in 2009 with an improved score.

At the bottom end of the ladder of the ranking are Albania, Nigeria, Paraguay, Azerbaijan, Bosnia-Herzegovina, Chad, Venezuela, Guyana, Burundi, Zimbabwe, Angola and Bangladesh.

The United States ranked 15th on the list, tied with the United Kingdom. (And this report was done pre-Obama. Can't wait to see how much the U.S. drops in next year's list.)

You can download the full 80-page report by following the link below:

Report: Property Rights Linked to Economic SecurityLabels: Economy

Memo to Obama: Please shut up!

Lowman S. Henry, writing at Lincoln Blog, has a request for Barack Obama and his administration. When it comes to the economy, "Please shut up!"

Henry says Obama may be the first president in history "to talk us into a recession."

From Henry:

"Every time the President or other top administration officials open their mouths the stock markets take another dive. Now at its lowest point since 1997, the markets have issued a resounding vote of no confidence in the President's policies.

What the markets fear most is uncertainty, and concerns about whether or not the most liberal administration in American history is set to nationalize one or more of the nation's biggest banks have frayed nerves on Wall Street."

The Obama Media won't point fingers at The Chosen One, but the Dow has dropped steadily during Obama's first month in the White House. Both the Dow Jones industrial average and the Standard & Poor's 500 index hit 12-year lows on Monday as Obama continues to send mixed signals. It's clear Wall Street has no confidence in Obama or his economic advisers.

Read Henry's full post at

Lincoln BlogLabels: Barack Obama, Economy

Monday, February 23, 2009

Voter remorse

Knowing what we know now about Barack Obama's first 30 days as president, if the election were held today, would John McCain win? I think so. I believe millions of Obama voters are sobering up and beginning to realize what a terrible mistake they made on Nov. 4, 2008. They fell for the Obama charm and didn't realize the kind of damage he would do to the United States.

From a Colin McNickle column in

The Pittsburgh Tribune-Review:

History will show that the Obama-Dimmycrat Socialist Complex "Stimulus" Plan led us into a second Great Depression. At least one esteemed (or is it "steamed"?) economist thinks it will be in full force by the end of the second quarter. After all, it's the usual consequence of such massive interventionism.

As late Austrian economics pioneer Ludwig von Mises reminded in 1940, "Interventionist measures lead to conditions which ... are actually less desirable than those they are designed to alleviate.

"They create unemployment, depression, monopoly, distress. ... (And) if they stubbornly persist in the attempt to compensate by further interventions for the shortcomings of earlier interventions, they will find eventually that they have adopted socialism."

Why do we continually refuse to learn from history?

Labels: Barack Obama, Democrats, Economy

Democrats block 1.2 million new jobs

From American Energy Alliance President Thomas J. Pyle:

"Unlike the $790 billion stimulus package lawmakers just passed, increased offshore activity would fuel our economy without squandering taxpayer funds. In fact, oil and gas is one of the U.S.'s only industries in a position to put money into, rather than take money out of, the government's piggybank.

"With more than 85 billion barrels of recoverable oil and over 440 trillion cubic feet of natural gas located right off our shores, exploration in the OCS stands to contribute $273 billion annually to the national economy. That's good news, especially for the 46 states that now face a combined $350 billion budget shortfall for the next three fiscal years. Economic relief wouldn't end there -- America would sustain approximately 1.2 million well-paying jobs each year over the life of production.

Over a Million U.S. Jobs Locked Away in 'Off-Limits' Offshore ResourcesLabels: Barack Obama, Congress, Economy, Energy, High Gas Prices

Monday, February 16, 2009

A trillion here, a trillion there

From the

Competitive Enterprise Institute:

If the irony of using debt-based spending to solve a problem caused by debt-based spending has escaped you (I doubt it has), perhaps these fun facts will put things into perspective:

If you spent $1 every second, you'd have to keep spending for 412,000 years to get to $13 trillion. That means you'd have to start shortly after the time human beings first starting using stone tools and fire to get to $13 trillion today.

$13 trillion in one dollar bills weighs 28 million pounds. That's as much as 87 blue whales or 462 Statues of Liberty.

If you laid 13 trillion one-dollar bills end-to-end they'd reach from the earth to the sun and back...five times over. That's 946 million miles of greenbacks.

The amount we're looking at now—roughly $2 trillion between the Secretary Geithner's new bank bailout plan and President Obama's stimulus package—isn't small potatoes either. So what is $2 trillion?

$2 trillion is bigger than the entire Gross Domestic Product of our neighbor to the north, Canada. In fact, according to the IMF, only Japan, Germany, China, the United Kingdom, France, and Italy have bigger total economies than the combined bailout/stimulus plan—all other countries on Earth have economies smaller than $2 trillion per year.

Then there's the interest on this staggering debt, which isn't exactly small. Paying the interest on the current $10.7 trillion debt cost Americans $451.1 billion last year alone. How big is that?

That's $1478 dollars in interest for every man, woman, and child in the United States.

That's bigger than the annual budgets of New York ($121.1 billion), California ($111.1 billion) and Texas ($83.8 billion) combined

Labels: Debt, Economy

Thursday, January 29, 2009

The Democrats' Debt Plan

Don't forget to thank your nearest Democratic member of Congress for voting to add $2,700 in debt to every member of your family.

Missouri Congressman Roy Blunt explains why he voted against the Obama "stimulus" bill:

"Just 7% of the trillion dollars in this legislation is slated for immediate use and the rest funds everything from buying bureaucrats cars to refurbishing federal buildings," Blunt says. "That's certainly not a package that will help our economy recover any time soon, but it is a package that our children and grandchildren will be repaying for generations to come."

The Democrats' plan will cost every American more than $2,700, Blunt says in a statement.

"The size of the package passed by the House is staggering compared to past stimulus plans," Blunt says. "When President Franklin Roosevelt was facing 25 percent unemployment during the Great Depression, his entire 'New Deal' proposal would cost just half of the current trillion dollar package after being adjusted for inflation."

Read Blunt's full statement at the link below:

Blunt Votes Against Democrats' Debt PlanLabels: Barack Obama, Congress, Debt, Democrats, Economy

Wednesday, January 28, 2009

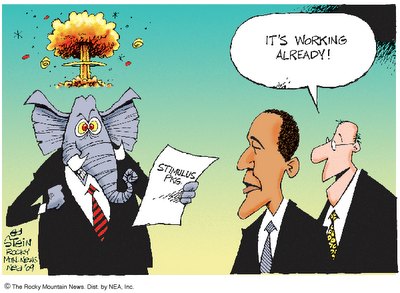

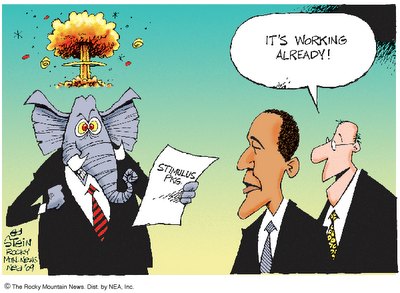

Stimulus already working?

The House of Representatives passed the Obama economic stimulus bill today by a vote of 244-188. Every Republican in the House and 11 Democrats voted against the $819 billion measure loaded with pork projects and expanded government programs that many economists say will have little impact on the nation's economic woes.

Rep. John Boehner of Ohio, the Republican leader, said bill will create few jobs, but "it will create plenty of programs and projects through slow-moving government spending."

Remember how Obama blasted George W. Bush for deficit spending? The Obama bill will send the federal deficit into the stratosphere.

A GOP alternative plan to cut taxes on middle class families was defeated by the Democrats, 266-170.

The Obama plan consists of $544 billion in new federal spending and just $275 billion in tax cuts for individuals and businesses.

So how much will you get? A $500 break for single workers and $1,000 for couples, far less than the Bush "stimulus" checks sent out last year. That government handout failed to slow down the recession or keep tens of thousands of Americans from losing their jobs.

The Obama plan also includes tax refunds for those who don't earn enough to owe federal income taxes. There's another word for that: Welfare.

The only hope to restructure the Obama government expansion bill is in the Senate, but with Democrats holding a solid majority there, don't hold your breath.

Just keep printing more money until the dollar is worthless.

Labels: Barack Obama, Congress, Debt, Democrats, Economy, Ed Stein Cartoon

200 economists oppose Obama 'stimulus'

POLICY BLOG has a post today about a new ad from the CATO Institute in which 200 leading American economists voice opposition to the Obama "stimulus" package.

You can read the ad in PDF form at

POLICY BLOG.

Make sure you let your member of Congress know that another ill-conceived expansion of government is now what the American economy needs. The Democrats pushed though the $750 billion bailout bill last fall and it's been a bust so far.

Labels: Bailout, Barack Obama, Congress, Democrats, Economy

Monday, January 26, 2009

Beware of Obama stimulus bill

Sunday, January 25, 2009

Columnist: Obama should follow Reagan lead

Washington Times columnist Diana West is troubled by President Obama's demand for $850 billion in new federal spending to get the U.S. economy moving again.

There's no evidence that massive government spending will boost the economy, West argues. And have we forgotten already how the $750 billion "bailout" Congress approved last fall has failed miserably?

From her latest column:

I found myself wondering how Ronald Reagan, entering office in 1981 with high inflation (12 percent) and unemployment (7.5 percent) higher than today (7.2 percent), and a contracting GDP approached hard times. In what turned out to be his first inaugural address, he, too, used the word "crisis" to describe "the economic ills" Americans were suffering. Noting that these ills were a long time coming and wouldn't go away "in days, weeks or months," he said: "But they will go away. They will go away because we, as Americans, have the capacity now, as we have had in the past, to do whatever needs to be done to preserve this last and greatest bastion of freedom."

"In this present crisis," he continued, "government is not the solution to our problem."

There's a twist. In this present crisis, according to the Obama administration and its stimulus-package trillions, government isn't just the solution, it's our only hope.

That's change for you.

Read the full column at

The Mercury Web site.

Labels: Bailout, Barack Obama, Congress, Conservatives, Democrats, Economy

Friday, January 23, 2009

Report: Obama bailout package will spark inflation

Friday, January 16, 2009

PA releases first 'State Of The Industry' Report

Check out BreakTheBailout.com

Tuesday, January 13, 2009

U.S. ranks 6th in world in economic freedom

Maybe we're just used to being No. 1 in everything, but I find it troubling that the United States finished no better than 6th in the 2009 "Index of Economic Freedom" published by The Wall Street Journal and The Heritage Foundation.

And with the Barack Obama administration taking over and Democratic control of Congress, look for the U.S. to slip even further in coming years.

The 10 freedoms measured by the Index are: business freedom, trade freedom, fiscal freedom, government size, monetary freedom, investment freedom, financial freedom, property rights, freedom from corruption and labor freedom. Ratings in each category were averaged to produce the overall Index score.

Here are the Top 10 countries:

1 Hong Kong

2 Singapore

3 Australia

4 Ireland

5 New Zealand

6 United States

7 Canada

8 Denmark

9 Switzerland

10 United Kingdom

To view the full ranking of 183 nations in each of the 10 categories, visit

www.heritage.org/indexNorth America Leads World in Economic Freedom, 2009 Index FindsLabels: Economy

Thursday, January 8, 2009

Obama's Latest Speech Continues to Ignore Small Businesses

Monday, January 5, 2009

Thursday, December 18, 2008

Monday, December 8, 2008

What if Big Oil wants a bailout?

Remember a few months ago when gasoline was $4 a gallon and the price of everything else we buy went up because of rising fuel prices?

How come prices haven't come down now that gas is below $2 a gallon?

I'm still paying more for a cup of coffee than I was a few months ago. I remember convenience stores announcing they had to add a surcharge to the price of coffee because of rising gas prices. Why didn't the surcharge come down?

My grocery bill hasn't gone down since the summer when food prices began to skyrocket. What gives?

With some experts forecasting that the price of gas will continue to tumble, will we see Big Oil head to Congress asking for help?

From The Christian Science Monitor:

What the price drop does mean is that some oil-patch wildcatters have packed up their drill bits as the rush for new domestic exploration has cooled since summer.

"Six months ago everything was roses, and nobody in this business had any inkling that oil prices would decline virtually $100 a barrel," says Alex Mills, president of the Texas Alliance of Energy Producers. Now, he says, "some people have already pulled back on their drilling programs."

No doubt, profits for Big Oil will tumble from this year's record highs. And because of the tightening credit market, many producers – majors and independents – will shut down drilling rigs and trim production in the year ahead.

Read "Oil industry adjusts to lower prices" at The Christian Science Monitor

Web site.

Labels: Economy, High Gas Prices

Monday, November 24, 2008

Sen. Robert Byrd on Potential Commerce Secretary Nominee Gov. Bill Richardson

Economic Crisis Makes 'Rubinomics' Irrelevant

President-elect Barack Obama should change his slogan to: "The more things change, the more they stay the same."

The seeds of the current economic crisis can be traced back to the Clinton Administration. Americans should be concerned that so many former Clinton officials are returning to key positions in the Obama Administration.

Economic Crisis Makes 'Rubinomics' IrrelevantLabels: Barack Obama, Economy

Wednesday, November 19, 2008

Study says PA among least competitive states

Looking for more evidence that Gov. Ed Rendell is to economics what Eagles head coach Andy Reid is to NFL coaching?

Pennsylvania is among the least competitive states when it comes to attracting and keeping businesses, according to a new study.

The Beacon Hill Institute, a free-market think tank based at Suffolk University in Boston, ranked Pennsylvania 39th out of the 50 U.S. states, according to The Philadelphia Business Journal.

It's the latest in a long line of independent evaluations of Pennsylvania's economic climate under Rendell that show the state near the bottom.

From the Journal article:

Researchers preparing the study looked at areas such as security, government and fiscal policy, environmental policy, human resources, technology and "business incubation."

Pennsylvania ranked near the middle or bottom in most areas, but fared well in the technology category, which included such factors as academic research and development, and National Institutes of Health support.

Just as the Eagles are not considered competitive under Andy Reid, Pennsylvania's economy is not competitive under Ed Rendell.

Perhaps they'd consider switching jobs. Rendell couldn't do any worse coaching the Eagles and Reid couldn't possible screw up the state's economy any more than Rendell has.

Read more about the study at the business publication's

Web site.

Labels: Economy, Pennsylvania, Rendell

Monday, November 17, 2008

Let's bail out newspapers

Since Congress is handing out checks to the banking industry, the housing industry, the financial services industry and the auto industry, how about some help for the struggling newspaper industry?

I just thought I'd ask.

Phil Heron, the editor of The Delaware County Daily & Sunday Times, writes about tough times facing newspapers in his latest column.

Heron writes:

We find ourselves under siege on all sides. Advertising is down. Way down. Revenues continue to decline. So does readership. The industry is struggling as readers move increasingly to the Internet as a source of news.

Of course, we also feature a Web site, but the print version we distribute each day remains the backbone of our financial model.

There are those who believe that newspapers are dinosaurs, that we are in the waning days of print. I'm still not sure I agree completely with that point of view. We have our challenges, there is little doubt of that.

But I also believe we continue to play an important role, in particular in our watchdog role over government.

But the numbers do not lie. Fewer and fewer people pick up the newspaper each day. That is especially true of young people, who clearly have not been ingrained with the habit of a daily newspaper, as I learned from my parents. They are much more inclined to get their news online.

It is not a particularly appealing picture. It makes you wonder about the future, about the newspaper’s role in it, maybe "if" the newspaper has a role in it.

Read the full column at the

newspaper's Web site.

Labels: Economy

Thursday, October 30, 2008

Economists warn against Obama tax policies

A group of 357 leading American economists have issued a joint statement warning that Barack Obama's economic policies would be disastrous for the U.S. economy.

Here's is their statement, posted online, along with their names:

Barack Obama argues that his proposals to raise tax rates and halt international trade agreements would benefit the American economy. They would do nothing of the sort. Economic analysis and historical experience show that they would do the opposite. They would reduce economic growth and decrease the number of jobs in America. Moreover, with the credit crunch, the housing slump, and high energy prices weakening the U.S. economy, his proposals run a high risk of throwing the economy into a deep recession. It was exactly such misguided tax hikes and protectionism, enacted when the U.S. economy was weak in the early 1930s, that greatly increased the severity of the Great Depression.

We are very concerned with Barack Obama's opposition to trade agreements such as the pending one with Colombia, the new one with Central America, or the established one with Canada and Mexico. Exports from the United States to other countries create jobs for Americans. Imports make goods available to Americans at lower prices and are a particular benefit to families and individuals with low incomes. International trade is also a powerful source of strength in a weak economy. In the second quarter of this year, for example, increased international trade did far more to stimulate the U.S. economy than the federal government's "stimulus" package.

Ironically, rather than supporting international trade, Barack Obama is now proposing yet another so-called stimulus package, which would do very little to grow the economy. And his proposal to finance the package with higher taxes on oil would raise oil prices directly and by reducing exploration and production.

We are equally concerned with his proposals to increase tax rates on labor income and investment. His dividend and capital gains tax increases would reduce investment and cut into the savings of millions of Americans. His proposals to increase income and payroll tax rates would discourage the formation and expansion of small businesses and reduce employment and take-home pay, as would his mandates on firms to provide expensive health insurance.

After hearing such economic criticism of his proposals, Barack Obama has apparently suggested to some people that he might postpone his tax increases, perhaps to 2010. But it is a mistake to think that postponing such tax increases would prevent their harmful effect on the economy today. The prospect of such tax rate increases in 2010 is already a drag on the economy. Businesses considering whether to hire workers today and expand their operations have time horizons longer than a year or two, so the prospect of higher taxes starting in 2009 or 2010 reduces hiring and investment in 2008.

In sum, Barack Obama's economic proposals are wrong for the American economy. They defy both economic reason and economic experience.

For more, check out the

Economists for McCain Web site.

Labels: Barack Obama, Economy, John McCain, Taxes

Wednesday, October 29, 2008

Did Your Congressman Cause the Financial Crisis?

WashingtonWatch.com has a list of House and Senate members who voted for a law that prevented states from regulating credit default swaps. "This set the stage for the market in 'financial derivatives' that are a big part of what is causing the economic meltdown today," according to WashingtonWatch.com

In Pennsylvania, the following House members backed the bill:

PA-1 Brady, Robert (D)

PA-6 Holden, Tim (D)

PA-11 Kanjorski, Paul (D)

PA-12 Murtha, John (D)

PA-18 Doyle, Michael (D)

PA-21 English, Philip (R)

For a list of the 155 House and 22 Senate members who supported the bill (and are up for re-election on Nov. 4), follow the link below.

Did Your Representative Cause the Financial Crisis?Labels: Congress, Economy

Ex-Subprime Bank Executive Finances Obama

Wednesday, October 15, 2008

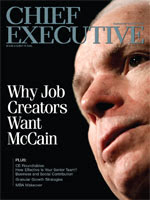

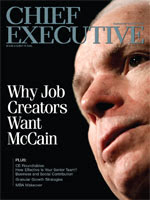

Job Creators Prefer McCain 4-To-1 Over Obama

Do you like your job? Would you like to keep your job?

As we head into what many experts predict will be a painful and prolonged recession, many people are worried about their jobs.

If you'd like to increase your chances of bringing home a paycheck, then you should vote for John McCain for president.

That what 80 percent of chief executive officers surveyed by Chief Executive magazine say. That's right. Eight out of 10 support McCain's economic plans.

The CEOs believe McCain would do a better job of handling the economy and preserving jobs. The business executives perceive Barack Obama as anti-growth.

Obama's tax policies would sink the fragile economy deeper into recession and cut jobs, the CEOs believe.

From Chief Executive magazine:

It is clear jobcreating Business leaders chose McCain over Obama largely because his policies are seen as pro-growth, whereas Obama's policies are viewed as redistributive and anti-growth.

For some months during this Presidential election year, Chief Executive has conducted specialized polling of CEOs' attitudes on issues affecting national policy and the economy. In CE's most recent poll in September, 751 respondents, more than double the usual number of business leaders, made their voices heard on their Presidential choice. By a four-to-one margin CEOs support Senator John McCain over his rival, Senator Barack Obama. More to the point, a thundering 74 percent majority say they fear the consequences of an Obama presidency, compared to only 19 percent who fear a McCain presidency.

During this period CE also asked the people who create jobs what it will take to get our engine of job creation going strong. We first asked CEOs what policies and approaches would work best for business, energy policy and job creation. Subsequently, we asked CEOs which Presidential candidate's policies were best aligned with these prescriptions for growth.

Read the full story and review more polling results at the

magazine's Web site.

Labels: Barack Obama, Economy, Jobs, John McCain, Taxes

Monday, October 13, 2008

100 U.S. economists issue warning about Obama

One-hundred leading American economists, including five Nobel Prize winners, have released a joint statement saying Barack Obama's economic proposals would be disastrous for the United States.

"Barack Obama's economic proposals are wrong for the American economy," the statement concludes. "They defy both economic reason and economic experience."

Here is the full statement:

Barack Obama argues that his proposals to raise tax rates and halt international trade agreements would benefit the American economy. They would do nothing of the sort. Economic analysis and historical experience show that they would do the opposite. They would reduce economic growth and decrease the number of jobs in America. Moreover, with the credit crunch, the housing slump, and high energy prices weakening the U.S. economy, his proposals run a high risk of throwing the economy into a deep recession. It was exactly such misguided tax hikes and protectionism, enacted when the U.S. economy was weak in the early 1930s, that greatly increased the severity of the Great Depression.

We are very concerned with Barack Obama's opposition to trade agreements such as the pending one with Colombia, the new one with Central America, or the established one with Canada and Mexico. Exports from the United States to other countries create jobs for Americans. Imports make goods available to Americans at lower prices and are a particular benefit to families and individuals with low incomes. International trade is also a powerful source of strength in a weak economy. In the second quarter of this year, for example, increased international trade did far more to stimulate the U.S. economy than the federal government's "stimulus" package.

Ironically, rather than supporting international trade, Barack Obama is now proposing yet another so-called stimulus package, which would do very little to grow the economy. And his proposal to finance the package with higher taxes on oil would raise oil prices directly and by reducing exploration and production.

We are equally concerned with his proposals to increase tax rates on labor income and investment. His dividend and capital gains tax increases would reduce investment and cut into the savings of millions of Americans. His proposals to increase income and payroll tax rates would discourage the formation and expansion of small businesses and reduce employment and take-home pay, as would his mandates on firms to provide expensive health insurance.

After hearing such economic criticism of his proposals, Barack Obama has apparently suggested to some people that he might postpone his tax increases, perhaps to 2010. But it is a mistake to think that postponing such tax increases would prevent their harmful effect on the economy today. The prospect of such tax rate increases in 2010 is already a drag on the economy. Businesses considering whether to hire workers today and expand their operations have time horizons longer than a year or two, so the prospect of higher taxes starting in 2009 or 2010 reduces hiring and investment in 2008.